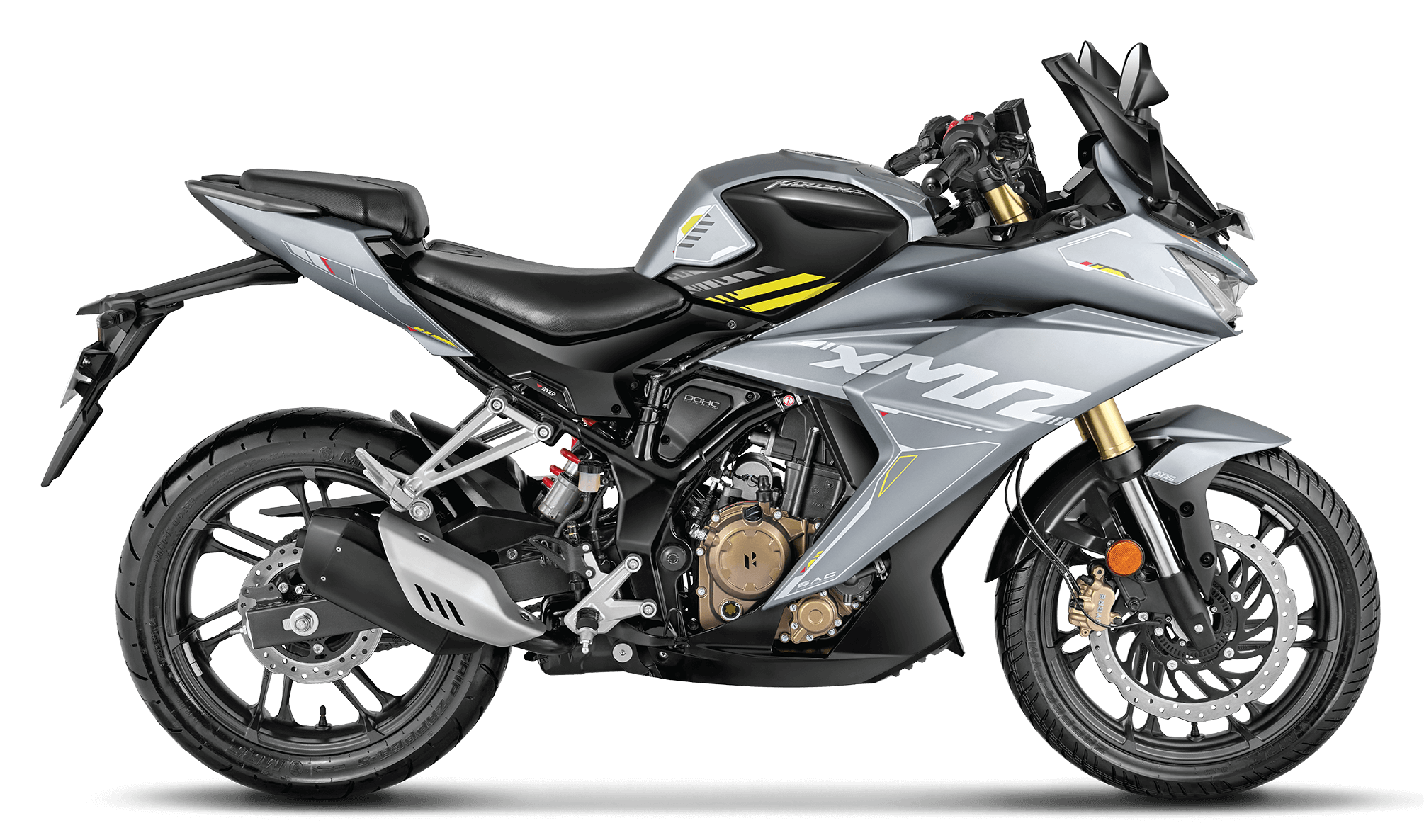

210 cc engine

.png)

.png)

Shareholder Resources

Important information for members regarding Dividend

Pursuant to the amendment in the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘SEBI Listing Regulations’), the provisions relating to "payable-at-par" warrants or cheques have been omitted from Regulation 12 and Schedule I of SEBI Listing Regulations.

Consequently, all dividend payments will now be remitted only through electronic mode.

Shareholders are advised to ensure that their bank account details are registered or updated with their Depository Participant in case shares are held in dematerialised form or with the Company’s Registrar and Share Transfer Agent, KFin Technologies Limited (“RTA”) for shares held in physical form.

For any support, please contact the RTA at einward.ris@kfintech.com and the Company at secretarialho@heromotocorp.com.

SHAREHOLDER RESOURCES

INFORMATION TO SHAREHOLDERS

.png)

The IEPFA vide its E-file No. 30/06/2025-IEPFA dated July 16, 2025 has proposed to initiate 100 Days’ Campaign – “Saksham Niveshak”, for the shareholders, whose dividends are unpaid/unclaimed. As per the directive of IEPFA, Hero MotoCorp Limited (Company) has initiated the 100 Days’ Campaign, “Saksham Niveshak”, for the shareholders, whose dividends are unpaid/unclaimed. Shareholders may write to secretarialho@heromotocorp.com for the required assistance.

Read more

Read less

IEPFA Directive

The SEBI vide its circular no. HO/38/13/11(2)2026-MIRSD-POD/ I/3750/2026 dated January 30, 2026, has opened a Special Window for transfer and dematerialisation of physical shares.

Read more

Read less

Circular

The Securities and Exchange Board of India vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2024/81 dated June 10, 2024 has, inter-alia, decided that non-submission of the “choice of nomination” shall not result in freezing of Demat Accounts as well as Mutual Fund Folios.

The complete copy of the circular is enclosed below.

Read More

Read Less

Circular

SEBI vide circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2024/37 dated May 07, 2024 has issued a Master Circular for Registrars to an Issue and Share Transfer Agents.

Read more

Read less

Circular

The SEBI vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2023/193 dated December 27, 2023 has extended the last date for submission of ‘choice of nomination’ for demat accounts to June 30, 2024.

The complete copy of the circular is attached below.

Read more

Read less

Circular

The SEBI vide its circular no.SEBI/HO/MIRSD/POD-1/P/CIR/2023/181 dated November 17, 2023 has removed the following provisions with respect to physical folios:

The folios wherein PAN, Nomination, Contact details, Bank A/c details and Specimen signature are not available on or after December 31, 2023 shall be frozen by the RTA.

The folio(s) which have been frozen shall be referred by the Company/RTA to the administering authority under the Benami Transactions (Prohibitions) Act, 1988 and or Prevention of Money Laundering Act, 2002, if they continue to remain frozen as on December 31, 2025.

The complete copy of the circular is attached below.

Read more

Read less

Circular

The SEBI vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2023/158 dated September 26, 2023 has extended the last date from September 30, 2023 till December 31, 2023 for submission of the following documents/information to avoid freezing of folios/demat accounts:

For physical shareholders - PAN, Nomination, Contact details, Bank A/c details and Specimen signature; and

For demat account holders – submission of choice of nomination.

Note: For trading accounts, ‘choice of nomination’ has been made voluntary.

Read more

Read less

Circular

The SEBI vide its master circular no. SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/145 dated July 31, 2023 (updated as on August 4, 2023) provided for a common online dispute resolution portal for resolving grievances/disputes of investors in the Indian Securities Market. In line with this circular, a gradual process for resolving disputes of investors exist under the ambit of SEBI and Stock Exchanges & Depositories. Therefore, in case of any grievances, the investor shall first approach the Company/RTA. If the investor is not satisfied with the resolution provided by the Company/RTA, he/she may file the concern/complaint on SCORES which is SEBI's investor grievance redressal portal. If the investor is further dissatisfied with the resolution on SCORES, he/she may file the concern/grievance on SMART ODR and the issue will be redressed accordingly. The link of SCORES Portal and SMART ODR Portal are provided hereunder for quick access. Further, the complete copy of the circular is also placed below.

Read more

Read less

Circular

PROCEDURE FOR DEMATERIALISATION (DEMAT)

- The client (registered owner) will submit a request to the DP in the Dematerialisation Request Form for dematerialisation, along with the certificates of securities to be dematerialised. Before submission, the client has to deface the certificates by writing "SURRENDERED FOR DEMATERIALISATION"

- The DP will verify that the form is duly filled in and the number of certificates, number of securities and the security type (equity, debenture etc.) are as given in the DRF. If the form and security count is in order, the DP will issue an acknowledgement slip duly signed and stamped, to the client.

- The DP will scrutinize the form and the certificates. This scrutiny involves the following:

- Verification of Client's signature on the dematerialisation request with the specimen signature (the signature on the account opening form). If the signature differs, the DP should ensure the identity of the client.

- MOA & AOA

- Formats: Deduction of Tax at source on Dividend Payment

- Annual Return

- Formats

- PAN, KYC & Nomination Details in terms of SEBI Circular no. SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/37 dated March 16, 2023

- Forms for registering / updating the KYC details

- Forms for processing of various service requests

Click to download our MOA & AOA.

Memorandum and Articles of Association of Hero MotoCorp Ltd. - 4.78 MB

Download

Click to download our Formats: deduction of tax at source on dividend payment.

Form 15G

Download

Form 15H

Download

Declaration under Rule 37BA

Download

Self declaration for DTAA applicability

Download

Self declaration for Resident SH other than Individuals

Download

Self declaration for Resident SH other than Individuals

Download

Click to download our Formats.

Application Change of Name - 12.76 KB

Download

Recording Change Of Name - 12.44 KB

Download

Application Correction Of Name - 13.01 KB

Download

Dividend Mandate Form - 15.69 KB

Download

Dividend Revalidation Form - 12.72 KB

Download

Application Duplicate Dividend Warrants - 13.15 KB

Download

Indemnity Bond - 16.40 KB

Download

Name Deletion Form - 46.41 KB

Download

Application Registration of Power of Attroney - 13.10 KB

Download

Specimen Signature Form - 12.30 KB

Download

Click to download our Formats: deduction of tax at source on dividend payment.

Intimation under Regulation 30- 08.10.2025 - 890.18 KB

Download

Intimation to Shareholders - 20-Aug-25 - 1.04 MB

Download

Intimation under Regulation 30- 19.08.2025 - 1.39 MB

Download

Intimation under Regulation 30- 01.07.2025

Download

Click to download our Forms for registering / updating the KYC details.

Bank details - ISR-1 - 983.29 KB

Download

Contact details (Postal address, Mobile number & E-mail) - ISR-1 - 983.29 KB

Download

Nominee Details - SH-13, SH-14, ISR-3 (as applicable) - 621.12 KB

Download

PAN - ISR-1 - 983.29 KB

Download

Signature - ISR-1, ISR-2 (as applicable)1 - 1.69 MB

Download

Click to download our Forms for processing of various service requests.

Change in status from Minor to Major and Resident to NRI and vice versa - 1.26 MB

Download

Change in the name of the holder-ISR-4 - 556.83 KB

Download

Claim from Unclaimed Suspense Account & Suspense Escrow Demat Account - ISR-4 - 556.83 KB

Download

Consolidation of folios - ISR-4 - 556.83 KB

Download

Consolidation of securities certificate- ISR-4 - 556.83 KB

Download

Endorsement - ISR-4 - 556.83 KB

Download

Issue of Duplicate securities certificate - ISR-4 - 556.83 KB

Download

Replacement Renewal Exchange of securities certificate - ISR-4 - 556.83 KB

Download

Sub-division Splitting of securities certificate - ISR-4 - 556.83 KB

Download

Transmission - ISR-4, ISR-5 - 1.36 MB

Download

Transposition - ISR-4 - 556.83 KB

Download

TRANSFER OF SHARES

GUIDANCE NOTE:

SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 mandates that the transfer, except transmission and transposition, of securities shall be carried out in dematerialized form only, with effect from 1st April 2019.

For any further queries you may please write to the Company's RTA.

In view of the numerous advantages offered by the Depository system as well as the ease of holding, members holding shares in physical mode are advised to avail of the facility of dematerialization from either of the depositories and get their physical shares dematerialized.

Are shares of Hero MotoCorp required to be traded compulsorily in demat form? Can a Shareholder hold the shares in physical form?

Yes. The shares of Hero MotoCorp are to be compulsorily traded in demat form. However, one can still hold the shares in physical form.

In view of the numerous advantages offered by the Depository system as well as the ease of holding, members holding shares in physical mode are advised to avail the facility of dematerialization from either of the depositories and get their physical shares dematerialzed.

Can I gift my shares in physical form?

No. Gifting of shares is equivalent to transfer of shares therefore it can be done only in demat form.

I want to add another person as a joint-holder to my shareholding. Can this be done physically?

No. Any addition of name is deemed to be transfer of shares therefore it has to be done in demat form.

Can the Company convert my physical shares into demat form?

No. The Shareholder is required to approach a depository participant to get his/her shares dematerialised.

TRANSMISSION OF SHARES / DELETION OF NAME

I am the registered nominee in respect of securities where the sole holder is deceased. What is the procedure for transmission of securities?

Please submit the following documents to the RTA:

(a) Duly filled Transmission Request Form - Form ISR-5 (b) Original Death Certificate or copy of Death Certificate duly attested by the nominee subject to verification with the original or copy of death certificate duly attested by a notary public or by a gazetted officer (c) Original share certificate(s) (d) Self-attested copy of PAN card of the Nominee

I am the legal heir in respect of securities where the sole holder is deceased and nomination is not registered with the Company. What is the procedure for transmission of securities?

Please submit the following documents to the RTA:

(a) Duly filled Transmission Request Form - Form ISR-5.

(b) Original share certificate(s).

(c) Self-attested copy of the PAN card of the legal heir(s)/claimant(s)/Applicant(s).

(d) Original Death Certificate or copy of Death Certificate duly attested by the legal heir(s)/claimant(s) subject to verification with the original or copy of death certificate duly attested by a notary public or by a gazetted officer.

(e) Notarized Affidavit from all legal heir(s) made on non-judicial stamp paper of appropriate value, to the effect of identification and claim of legal ownership to the securities.

(f) a copy of Succession Certificate or Probate of Will or Will or Letter of Administration or Court Decree as may be applicable in terms of Indian Succession Act, 1925 (39 of 1925) or Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority, attested by the legal heir(s)/claimant(s) subject to verification with the original or duly attested by a notary public or by a Gazetted Officer.

Provided that in a case where a copy of Will or a Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted, the same shall be accompanied with a notarized indemnity bond from the legal heir(s) /claimant(s) to whom the securities are transmitted, in the prescribed format.

Provided further that in a case where a copy of Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted, the same shall also be accompanied with a No Objection certificate from all non-claimants, in the prescribed format.

(g) For value of securities, threshold limit of up to INR 5,00,000 or such other value as may be decided by the Board for shares held in physical form and upto INR 15,00,000 per beneficial owner in case of shares held in demat form, as on the date of the application, and where the documents mentioned in (f) above are not available, the legal heir(s)/Claimant(s) may submit the following documents :

(i) No objection certificate from all legal heirs who do not object to such transmission; or Copy of family settlement deed duly attested by notary public or by a gazetted officer and executed by all the legal heirs.

(ii) A notarized Indemnity bond made on appropriate non judicial stamp paper, indemnifying the Company / RTA.

If one of the joint holder is deceased, what is the procedure for name deletion?

Please provide the following documents to RTA:

- Name deletion request

- Original or copy of Death Certificate duly attested by nominee subject to verification with original

or copy of death certificate duly attested by a notary public or by a gazetted officer

- Relevant share Certificate

- Self-attested copy of PAN card

Transmission of Securities in Joint Demat Accounts i.e. deletion of name.

In case of death of the holder(s) in joint demat account, the surviving holder (s) may opt to continue the existing demat account by deleting the name of deceased account holder(s) from the demat account, by submitting to the depository participant a specific request along with the original death certificate or copy of death certificate attested by the joint account holder(s) subject to verification with the original or copy of the death certificate duly attested by a notary public or by a gazetted officer or death certificate downloaded from the online portal of Government carrying digital/facsimile signature of the issuing authority.

In case, if the surviving holder(s) fails to submit above mentioned request within one year of the date of demise, a new demat account shall be opened by the surviving account holder(s) to execute transmission as per the existing procedure.

Please refer the NSDL circular no. NSDL/CIR/II/44/2023 dated November 07, 2023 for the operational guidelines for Transmission of Securities in Joint Demat Accounts i.e. deletion of name.

What is the procedure for issuance of shares post submission of all documents for transmission?

Please refer to the below process/ flow chart regarding issuance of shares post submission of all documents for transmission

NOTES:

For securities held in electronic form, please contact your Depository Participant.

For securities held in physical form, please ensure that your folio is KYC compliant. For more details on KYC compliance, please refer to faqs on KYC.

DOCUMENTS MENTIONED ABOVE ALONG WITH OTHER NECESSARY INFORMATION/DETAILS/DOCUMENTS, AS REQUIRED, SHALL BE SUBMITTED TO RTA.

Within 30 days of receipt of request by RTA & upon receipt of duly completed documents, RTA/Company shall issue Letter of Confirmation (LOC) & inform the same to the shareholder.

RTA shall retain the physical securities and deface the certificate with a stamp "LOC issued".

LOC shall be valid for 120 days

Within 120 days, claimant shall submit the DEMAT request along with original LOC to Depository Participant (DP)

DP shall generate the DEMAT request on the basis of LOC and forward the request to Company/ RTA for processing the DEMAT request.

In case no DEMAT request has been received from claimant, a reminder to be issued by RTA/Company after the end of 45 days and 90 days from the date of issuance of LOC.

In case no DEMAT request has been received from claimant within 120 days from the date of issue of LOC, shares shall be credited to Suspense Escrow Demat Account of the Company

NOMINATION IN RESPECT OF SHAREHOLDING

GUIDANCE NOTE:

If you wish to appoint a nominee, kindly download and fill in the enclosed Nomination Form (SH-13) and submit it to our RTA.

How can I make a nomination?

Please send the documents enclosed for – making a new Nomination

Singly, if you are a sole holder, or jointly, if you are joint holders, to our RTA – KFin Technologies Limited

After verifying your signatures and details, your nomination would be registered and an intimation of the same would be sent to you, which you are requested to preserve to avoid any future dispute

Who can make a nomination?

The nomination can be made only by individual(s) holding shares singly or jointly. If the shares are held jointly, all the joint holders will sign the nomination form. Non-individuals including a society, trust, body corporate, partnership firm, Karta of Hindu Undivided Family and holder of Power of Attorney cannot nominate.

Can a Shareholder nominate more than one person to hold shares jointly in the event of his demise?

Only one nomination can be made for each folio. In a family having different folios containing different order or combination of names of shareholders will require separate nominations for each folios.

Can a shareholder change his nomination?

Nomination once made can be revoked by a shareholder by giving a fresh nomination. If the nomination is made by joint holders, and one of the joint-holders dies, the remaining joint holder(s) can make a fresh nomination by revoking the existing nomination.

Please download form SH-14 for revocation of nomination along with documents enclosed for – Appointing a new Nomination or Revocation of nomination.

How does Hero MotoCorp establish the identity of the nominee in case of death of the shareholder?

The prescribed form SH-13 only provides for the name and address of the nominee. In addition to the above, the shareholder may also provide the specimen signature of the nominee duly attested by his banker where he/she is holding an account along with form SH-13.

Can the shareholders holding shares jointly make a nomination?

Yes. Shareholders holding shares jointly may together nominate a person to whom the shares shall vest in the event of death of all joint holders.

What is the effect of death of one of the joint holders on nomination?

In the unfortunate event of death of one of the joint holders, the surviving joint holders are the persons recognised by the Company as the holders of the shares. The death of one of the joint holders does not rescind the nomination. Nominee will have title to the shares only on the death of all the joint holders.

Can the surviving joint holder make a fresh nomination by revoking earlier nomination?

Nomination once made can be revoked by a shareholder by giving a fresh nomination. If the nomination is made by joint holders, and one of the joint-holders dies, the remaining joint holder/s can make a fresh nomination by revoking the existing nomination.

Please download form SH-14 for revocation of nomination and send it to our RTA along with documents enclosed for – Appointing a new Nomination or Revocation of nomination.

Can nomination be made in favour of a minor?

In the event of death of the shareholder, the shares shall vest with the guardian of the nominee as mentioned in the form.

What will happen when a shareholder dies leaving a minor nominee?

In the event of death of the shareholder, the shares shall vest with the guardian of the nominee as mentioned in the form.

Can shareholders nominate a person for a part of their holdings?

No, the nomination should be for the full holding and not part.

Does a Will by the shareholder override the nomination?

A Will or any other testamentary law/ instrument will override nomination.

Can a nominee transfer the shares after the death of the shareholder?

A nominee, after getting the shares transmitted in his name, is entitled to sell the inherited shares in dematerialised form in the open market. However, he is not allowed to transfer the shares in physical form post March 31, 2019.

Is the nominee entitled to dividend and other benefits before being registered as a member?

No. The nominee is required to complete all the formalities for the transmission process and once the name is registered in the register of members, the dividend and other benefits are accordingly released by the RTA.

Can the nominee exercise voting rights before being registered as a member?

A nominee is not entitled to exercise any voting rights before being registered as a member.

Is it necessary for shareholders holding shares in Demat form to nominate the same person whom they have appointed as their nominee for their shareholdings with the depository?

The nomination made by the shareholders in respect of electronic holdings is distinct from their nomination for the physical holdings. Hence, Hero MotoCorp will not recognize the nomination made by deemed members for their holdings in demat form. Such shareholders are given an option of nomination at the time of opening a demat account. However, the deemed members who have part of their holdings in physical form are entitled to make nomination in prescribed Form SH-13 for their physical holdings.

Can a Power of Attorney holder sign for the shareholder concerned appointing any person as nominee?

No, The Power of Attorney holder is not allowed to sign the nomination form on behalf of the shareholder.

Nomination form is an important document like Will. What precaution investors should take to ensure that their instruction as to transmission would be acted upon by Hero MotoCorp?

Upon receipt of documents from the shareholder, the signature and other details of the holder are verified and accordingly, the nominee name is updated in the system. On successful registration, an intimation letter is also sent to the investor with details of the nominee registered under the said folio/ Demat account.

Whether the heirs of the nominee are entitled to the shares, if the nominee dies before the nominator?

If the nominee dies before the nominator i.e shareholder, Hero MotoCorp shall transmit the shares in the name of the heirs or legal representatives of the registered shareholder or holder of the succession certificate. The heirs of the nominee are not entitled to the shares if the nominee has predeceased the shareholder.

PROCEDURES

APPOINTING A NEW NOMINATION OR REVOCATION OF NOMINATION

Duly filled up Form SH-13 (Nomination Form)

Note:

In case of appointing Nominee only one Nominee can be nominated per folioDuly filled up Form SH-14 (in case of revocation of nomination)

Self-attested copy of PAN Card of the Applicant and the Nominee

Self attested copy of any other identity proof of the Applicant and the Nominee

Proof of encashment of dividend received from the Company

LOSS OF SHARE CERTIFICATES/ RENEWAL AND ISSUE OF DUPLICATE SHARE CERTIFICATES

In case of loss of share certificates, what steps one should take to obtain duplicate share certificates?

Please submit a request for issuance of duplicate share certificates in Form ISR-4, format enclosed below, along with following duly completed documents:

Copy of FIR (Required only if value of securities as on date of submission of application is more than Rs. 5,00,000)

The below mentioned documents are also acceptable:

e-FIR

Police Complaint

Court injunction order

Copy of Plaint (where Suit filed has been accepted by the Court and Suit no. has been given)

All the above documents shall necessarily have the following details -

Details of the shares - no. of shares, face value , etc.

Folio no.

Distinctive no. , and

Certificate no.

For Overseas Shareholder , in lieu of FIR, following documents are acceptable:

Self-declaration of the security certificates lost/ stolen/ misplaced - duly notarised/ apostilled/ attested by Indian Consulate/ Embassy in their country of residence.

Self-attested copies of valid passport and overseas address proof

Affidavit- format enclosed below

Indemnity Bond duly attested by notary public - format enclosed below

Banker attestation form in ISR-2 - format enclosed below

Demand Draft for proportionate cost of Advertisement as may be specified by the Board of Directors/Delegated authority in this regard from time to time (Advertisement regarding loss of securities in a widely circulated newspaper is mandatory if value of securities as on date of submission of application is more than Rs. 5,00,000)

Please ensure that your folio is KYC compliant. To know more on KYC compliance, you are requested to refer to FAQS on KYC.

In case of loss of share certificates, what steps a Legal Heir/Nominee should take to obtain duplicate share certificates?

Please submit a request for issuance of duplicate share certificates cum transmission in Form ISR-4, format enclosed below, along with following duly completed documents:

Copy of FIR (Required only if value of securities as on date of submission of application is more than Rs. 5,00,000)

The below mentioned documents are also acceptable:e-FIR

Police Complaint

Court injunction order

Copy of Plaint (where Suit filed has been accepted by the Court and Suit no. has been given)

All the above documents shall necessarily have the following details -

Self-declaration of the security certificates lost/ stolen/ misplaced - duly notarised/ apostilled/ attested by Indian Consulate/ Embassy in their country of residence.

Self-attested copies of valid passport and overseas address proof

Affidavit and Indemnity bond duly attested by notary public - format enclosed below

Self-attested copy of the PAN card of the Applicant(s)

Documents required for transmission (Pls refer to Faqs on transmission)

Demand Draft for proportionate cost of Advertisement as may be specified by the Board of Directors/Delegated authority in this regard from time to time (Advertisement regarding loss of securities in a widely circulated newspaper is mandatory if value of securities as on date of submission of application is more than Rs. 5,00,000)

In case of loss of share certificates, what steps a Transferee should take to obtain duplicate share certificates?

Please submit a request for issuance of duplicate share certificates cum transfer in Form ISR-4, format enclosed below, along with following duly completed documents:

Evidence for discharge of consideration i.e. copy of passbook.

Copy of postal acknowledgement / receipt issued by the courier through whom the transfer documents were sent but lost in transit (if share certificates were lost in transit) / stolen.

Copy of postal acknowledgement / receipt issued by the courier through whom the transfer documents were sent but lost in transit (if share certificates were lost in transit) / stolen.

Copies of transfer documents (if retained).

Copy of FIR (Required only if value of securities as on date of submission of application is more than Rs. 5,00,000)

The below mentioned documents are also acceptable:

e-FIR

Police Complaint

Court injunction order

Copy of Plaint (where Suit filed has been accepted by the Court and Suit no. has been given)

All the above documents shall necessarily have the following details -Details of the shares - no. of shares, face value , etc.

Folio no.

Distinctive no. , and

Certificate no.

For Overseas Shareholder, in lieu of FIR, following documents are acceptable:

Self-declaration of the security certificates lost/ stolen/ misplaced - duly notarised/ apostilled/ attested by Indian Consulate/ Embassy in their country of residence.

Self-attested copies of valid passport and overseas address proof

Affidavit and Indemnity bond duly attested by notary public

Self-attested copy of the PAN card of the Applicant

Documents required for transfer (Please refer the Faqs on Transfer of Shares)

Demand Draft for proportionate cost of Advertisement as may be specified by the Board of Directors/Delegated authority in this regard from time to time (Advertisement regarding loss of securities in a widely circulated newspaper is mandatory if value of securities as on date of submission of application is more than Rs. 5,00,000)

How would the applicant/shareholder quantify the value of securities?

The applicant shall quantify the value (whether it is exceeding Rs. 5 lakhs or not) of the securities on the basis of the closing price of such securities at any one of the recognized stock exchanges a day prior to the date of such submission in the application.

In case of non-availability of certificate nos./distinctive nos./folio nos, what steps shareholder should take?

TThe shareholder should send a written request to the RTA along with his/her registered signature and address to know the above details. Only where the signature & address of the shareholder matches with the RTA/Company's records, the RTA will provide the requested information/details.

In case the signature and/or the address do not match, the shareholder shall first comply with the KYC procedure and then only the details of the securities shall be provided to the shareholder by the RTA/Company.

In which form/mode, duplicate share certificates will be issued?

As mandated vide SEBI Circular dated January 25, 2022, duplicate share certificates shall be issued in dematerialized mode only.

What documents are required for the issuance of duplicate share certificates in respect of the shares which have been transferred to the IEPF?

Along with the above mentioned documents/details, the shareholder shall also submit the following:

- Surety Affidavit along with his proof of identity like PAN card of sureties duly attested by Notary

What action should be taken in case the share certificates are retrieved by the holder, which were earlier reported to be lost?

Please surrender the original share certificates to the RTA immediately if the duplicate share certificates (Letter of Confirmation) have been issued. However, if the original share certificates are found before you comply with the procedure for obtaining duplicate share certificate, please inform the RTA immediately so that the Company can take suitable action.

The share certificate(s) held by me have been defaced, mutilated, torn or old, worn out. Will such share certificate(s) be considered valid. If not, then what steps should one take for replacement/ renewal?

Please submit a request for renewal of share certificates in Form ISR-4, format enclosed below, along with following duly completed documents:.

Original Share Certificate(s)

Self-attested copy of the PAN card of the Applicant

What is the process for issuance of duplicate share certificates / renewal of certificates in dematerialized mode?

Process/Flow chart for issuance of duplicate share certificate in dematerialised form is provided below.

What documents are required for split/consolidation of share certificates

Application (Board Resolution and list of signatories in case applicant is a body corporate)

Original Share Certificate(s)

Self-attested copy of the PAN card of the applicant

Address proof of the applicant

Bank statement showing encashment of any previous dividend received from the Company

PROCEDURES

DOCUMENTS REQUIRED FOR ISSUE OF DUPLICATE SHARE CERTIFICATE

Duly signed written application (signed by all shareholders) for duplicate share certificates.

Lodge an FIR with the local police station ensuring the following:

It should contain the complete details of shares lost i.e. Name of the Company, Folio no., No. of shares, Share certificate no(s). and Distinctive nos.;

It should also state the reason for delay in lodging the FIR, if applicable;

In case the same is in regional language, then a true copy of its translation in English language; &

It should be duly attested by Notary Public.

Execute an affidavit on a non-judicial stamp paper of Rs. 100/- (or of such appropriate value as applicable in the state of execution of this Affidavit) affirming the factum of loss of shares and change/variation in signatures/address/name of the investor, as may be applicable.

Execute an Indemnity Bond, on a non–judicial stamp paper of the value of Rs. 100/- (or of such appropriate value as applicable in the state of execution of this Bond), duly attested by Notary Public.

Submit the Surety Form along with the documents as prescribed below:

Self attested PAN card;

Latest Income Tax Return filed;

Address proof;

ID proof

Self-attested copy of PAN card of the Applicant.

Self-attested copy of Residence proof of the applicant which should match with the registered address recorded in the Company i.e., Aadhaar card or valid Passport or Driving License or Utility bills like Telephone Bill, Electricity bill & Gas Bill (not more than 3 months old).

Bank statement showing encashment of any previous dividend received from the Company

Banker attestation form

Cancelled cheque

Remit the following proportionate cost towards advertisement to be issued by Hero MotoCorp Limited in a national English daily and a Hindi newspaper by way of a demand draft in favour of “Hero MotoCorp Limited” payable at par at New Delhi:

for Rs.5000/-, when no. of shares held is 100 or more;

for Rs.2000/-, when no. of shares held is less than 100.

Note:

If there is change in address we will ask for Change of Address procedure.In case request is made by the Legal Heir/ Nominee, provide the following documents:

DOCUMENTS REQUIRED FOR REPLACEMENT/ RENEWAL OF SHARE CERTIFICATE

Application

Original Share Certificate(s)

Self-attested copy of the PAN card of the Applicant

Address proof of the Applicant which should match with the registered address in the record of the Company

Bank statement showing encashment of any previous dividend received from the Company

SPLIT/ CONSOLIDATION OF SHARE CERTIFICATES

Application (Board Resolution and list of signatories in case applicant is a body corporate)

Original Share Certificate(s)

Self-attested copy of the PAN card of the applicant

Address proof of the applicant

Proof of encashment of dividend received from the Company

PROCESS/FLOW CHART FOR ISSUANCE OF DUPLICATE SHARE CERTIFICATE IN DEMATERIALISED FORM:

DOCUMENTS MENTIONED ABOVE ALONG WITH OTHER NECESSARY INFORMATION/DETAILS/DOCUMENTS, AS REQUIRED, SHALL BE SUBMITTED TO RTA.

within 30 days of receipt of request by RTA & upon receipt of duly completed documents, RTA/Company shall issue Letter of Confirmation (LOC) & inform the same to the shareholder.

RTA shall retain the physical securities and deface the certificate with a stamp "LOC issued".

LOC shall be valid for 120 days

Within 120 days, claimant shall submit the DEMAT request along with original LOC to Depository Participant (DP)

DP shall generate the DEMAT request on the basis of LOC and forward the request to Company/ RTA for processing the DEMAT request.

In case no DEMAT request has been received from claimant, a reminder to be issued by RTA after the end of 45 days and 90 days from the date of issuance of Letter of Confirmation.

In case no DEMAT request has been received after 120 days from the date of issue of LOC, shares shall be transferred to Suspense Escrow Demat Account of the Company

DEMATERIALISATION OF SHARES

What is Demat and what are its benefits?

Dematerialisation ('Demat' in short form) signifies conversion of a share certificate from its present physical form to electronic form for the same number of holding.

It offers scope for paperless trading through state-of-the-art technology, whereby share transactions and transfers are processed electronically without involving any share certificate or transfer deed after the share certificates have been converted from physical form to electronic form.

Demat attempts to avoid the time consuming and complex process of getting shares transferred in the name of buyers as well its inherent problems of bad deliveries, delay in processing/fraudulent interception in postal transit, etc.

Dematerialisation of shares is optional and an investor can still hold shares in physical form. However, as per SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015, with effect from 1st April 2019, the transfer, except transmission and transposition, of securities shall be carried out in dematerialized form only.

The two Depositories in operation are National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

Following are some of the advantages of maintaining the securities in Dematerialised form:

A safe, convenient way to hold securities;

Immediate transfer of securities;

Elimination of risks associated with physical certificates such as bad delivery, fake securities, Delays in transit, thefts etc.

Change in address recorded with DP gets registered with all companies in one go in which the investor holds securities electronically thereby eliminating the need to correspond with each of them separately;

Easy Nomination facility;

Smooth Transmission of securities in case of any eventualities.

What are the chances of any fraud/disputes in using a demat account? Whom should I approach in such cases?

Common risk factors applicable to trading in physical shares like mismatch in signatures, loss in postal transit, etc., are absent since the dematerialised shares are traded scrip-less.

However, in an unlikely event of any other dispute, the concerned Stock Exchange and/or Depository viz. NSDL/CSDL or Securities and Exchange Board of India, may be approached for resolving such issues.

How can services of a depository be availed?

To avail the services of a depository one is required to open an account with any of the Depository Participant (DP) of National Securities Depository Limited (NSDL) or Central Depository Services (India) Limited (CDSL). Once the account is opened, a unique Client ID number would be allotted to the investor.

What procedure one should follow for dematerialisation of shares?

One may follow the procedure of dematerialisation, available on the Investor section of Company website under the section of “Shareholder Resources”.

Can one open multiple accounts?

Yes. One can open more than one account in the same name with the same DP at their different locations as well as with different DPs.

Does one need to have any minimum balance of securities in his account?

No. He does not require maintaining any such minimum balance of securities.

What is required to be done if one has physical certificates with the same combination of names, but the sequence of names is different i.e. some certificates with 'A' as first holder and 'B' as second holder and other set of certificates with 'B' as first holder and 'A' as the second holder?

In this situation one may open only one account with 'A' & 'B' as the account holders and lodge the security certificates with different order of names for dematerialisation in the same account. One needs to fill-up an additional form called "Transposition cum Demat" form, which is provided by the DP, whenever any such account is being opened. This would help to effect change in the order of names while dematerialising the securities.

What is delivery instruction slip (DIS)? What precautions does one need to observe with respect to Delivery Instruction Slips?

To give the delivery instruction to DP you have to fill one form called Delivery Instruction Slip (DIS). DIS may be compared to cheque book of a bank account.

The following precautions are to be taken in respect of DIS:

Ensure and insist with DP to issue DIS book;

Ensure that DIS numbers are pre-printed and DP takes acknowledgment for the DIS booklet issued to investor;

Ensure that your account number [client id] is pre-printed;

If the account is a joint account, all the joint holders have to sign the instruction slips. Instruction cannot be executed if all joint holders have not signed;

Do not use loose slips;

Do not leave signed blank DIS with anyone viz., broker/sub-broker; and

Keep the DIS book under lock and key when not in use.

What should I do if there are any discrepancies in transaction statement?

In case of any discrepancy in the transaction statement, you can contact your DP. If the discrepancy cannot be resolved by the DP, you should approach the Depository.

PROCEDURES

DEMATERIALISATION/ REMATERIALIZATION

In case of Dematerialisation

Demat Requisition Form (as per the format provided by the Depository Participant, where the demat account is opened)

Original Share Certificate(s)

In case of Rematerialisation

1. Remat Requisition Form

DIVIDEND

I have not received my dividend, what action should I take?

You may write to the RTA furnishing the documents required for – Duplicate Dividend Warrant, while also quoting your folio number/client ID particulars (in case of demat shares).

I have received dividend but why company has deducted the tax on it?

In terms of the provisions of the Income-tax Act, 1961, as amended by the Finance Act, 2020, dividend paid or distributed by a Company on or after 1st April, 2020, shall be taxable in the hands of the shareholders. Therefore, the Company is required to deduct tax at source (TDS) at the time of payment of dividend in accordance with the provisions of the Act. For any further details/ queries you may please write to the Company’s RTA.

What is the procedure for obtaining a duplicate dividend warrant?

If the validity period of the lost dividend warrant has not yet expired, one will have to wait till the expiry date since no duplicate can be issued during the validity of the original warrant. However, after the expiry of the validity period, one may inform the RTA and furnish the documents required for – Duplicate Dividend Warrant

On receipt of the required documents, the RTA would verify the same and request the Company to transfer the dividend amount, directly into the Bank account (details provided by the shareholder/ claimant) by way of NEFT/ RTGS.

Can I claim the old dividends relating to past years that have not been received by me?

As per the present law, the company retains all unpaid/unclaimed dividends for the past seven years. If one has not received any of these dividends, he/ she should write to our RTA with relevant particulars such as folio number/DP ID & Client ID, concerned dividend, year etc., and the Company shall arrange to pay the dividend remaining unpaid in the records.

What happens to dividend, which remains unpaid/unclaimed for more than 7 years?

In case of dividend amount remaining unpaid/unclaimed for a period more than 7 years then the said amount is necessarily transferred to the "Investor Education and Protection Fund" (IEPF), constituted by the Central Government.

For the unpaid/ unclaimed dividend, which has been transferred to IEPF authority, the required documents are required to be submitted to the RTA and accordingly an “Entitlement Letter” would be issued for claiming the same from IEPF.

For claiming the shares from IEPF authority, one would be required to follow the procedure as provided on www.iepf.gov.in.

In order to protect against fraudulent encashment, how can one update/ incorporate his bank account details in the folio/ demat account. What is the procedure that he should follow?

Please furnish the documentation enclosed for “Updating Bank details/Dividend Mandate form” to our RTA, in case the shares are held in physical form. However, if one is holding the shares in electronic/ demat mode then such details needs to be furnished to the respective Depository Participant with whom one holds the demat account and not to the Company/ RTA.

Kindly note that no dividend warrant will be issued if the dividend payment is made online.

Why can't Hero MotoCorp take on record the bank details in case of shares held in demat mode?

As per the Depository Regulations, the Company is obliged to pay dividend as per the details of demat shareholders furnished by the concerned Depository Participant. However, if in case one needs to record his mandate then such details need to be furnished to the respective Depository Participant with whom one holds the demat account and not to Hero MotoCorp or its RTA Agent, as we are not authorised to make or incorporate any change in records received from the Depository.

PROCEDURES

DIVIDEND WARRANT REVALIDATION (where the original dividend warrant is not available)

Application for issuance of duplicate dividend warrant

Self-attested copy of PAN Card

Indemnity bond executed on non-judicial stamp paper of appropriate value, as prescribed under Stamp Act according to the state. If the value of dividend is below Rs. 1,000/-, then the indemnity bond may be executed on a plain paper.

Bank statement for encashment of any dividend received from the Company previously

Copy of cancelled cheque for transfer of dividend amount through online banking platform.

If the shares are in electronic form, updated client master list is required.

DIVIDEND WARRANT REVALIDATION (where the original dividend warrant is available)

Application for issuance of duplicate dividend warrant

Self-attested copy of PAN Card

Indemnity bond executed on non-judicial stamp paper of appropriate value, as prescribed under Stamp Act according to the state. If the value of dividend is below Rs. 1,000/-, then the indemnity bond may be executed on a plain paper.

Bank statement for encashment of any dividend received from the Company previously

Copy of cancelled cheque for transfer of dividend amount through online banking platform.

If the shares are in electronic form, updated client master list is required.

CHANGE IN CRITICAL DETAILS

If a shareholder wants to update the following details in his account/ folio, for shares are held in physical form, then what procedure should one follow:

a. Change in registered address

b. Change in registered name/ Correction in name

c. Change in specimen signatures

d. Change/ updation in e-mail / mobile no. / PAN

e. Transposition of name

f. Registration of Power of Attorney

One should furnish the documents/ information, as per the procedure enclosed.

In case the shares are held in Demat form then the shareholder is required to approach their respective Depository Participants for any change in the particulars of the demat account instead of submitting any documents with the Company/ RTA.

PROCEDURES

FOR DIVIDEND MANDATE

Application form

Original cancelled cheque

Self-attested copy of the PAN Card of the Applicant

Bank statement for encashment of last dividend received

Self-attested copy of any other identity proof like Aadhaar Card or Election Identity Card or Driving License or Electricity / Telephone (only land line) bill / Bank Account Statement / Passbook etc.

CHANGE IN REGISTERED NAME

Application Form alongwith self-attested documents to be submitted in Form ISR-1. Self-attested copy of PAN Card in the new name

If the Applicant(s) is an individual:

Marriage Certificate OR Divorce Decree OR On attaining majority- Birth Certificate/School Leaving Certificate OR Gazette Notification.Certificate of Incorporation along with Memorandum and Articles of Association

Certified true copy of the Board Resolution signed by the Company Secretary/ Director on the letterhead of the Company empowering the signatories to sign on behalf of the Company along with the specimen signature of the authorized signatories)

Certificate of Registration along with the Trust deed

The Resolution signed by the Secretary/Trustee on the letter head of the Trust empowering the signatories to sign on behalf of the Trust along with the specimen signature of the Authorized signatories

Certificate of Registration along with their Bye Laws/ Rules & Regulations

The Resolution signed by the Secretary/Trustee on the letter head of the Society empowering the signatories to sign on behalf of the Society along with the specimen signature of the Authorized signatories

Self-attested copy of previous identity proof (old name)

Original Share Certificate(s)

Bank statement for encashment of dividend received from the Company

If applicant is a Company –

If applicant is a Trust –

If applicant is a Society –

CHANGE IN REGISTERED ADDRESS

Application for registering change in Postal address in Form ISR-1.

Proof of the registered address:

Valid passport / Ration Card/ Registered Lease or Sale Agreement of Residence / Flat maintenance bill

Driving licence

Electricity bill*

Telephone bill (Landline)*

Gas bill*

Identity card / document with address issued by either Central /State Government and its departments, Statutory / Regulatory Authorities, PSUs, Scheduled Commercial Banks. Public Financial Institutions.

For FII /sub account, POA given by FII /sub account to the Custodians (which are duly notarized and / or apostilled or consularised) that gives the registered address.

The proof of address in the name of the spouse.

Client Master List (CML) of the Demat Account of the holder / claimant, provided by the Depository Participant.

*Documents under point 3,4,5 should not be more than 3 months old

In case the documents submitted as Flat Maintenance Bill or Proof of address in the name of spouse, additional self-attested copy of Identity Proof of the holder/claimant may be obtained.

RTAs shall forthwith send intimation about the request for change in address to the holder at both the old and new addresses by Speed post, providing timeline of 15 days for raising objection, if any.

a) In case the signature matches with the record available with the RTA, the request for change in address can be processed without keeping it on hold for 15 days as above. Documentary proof for old address will be required in such cases.

In case where there is a mismatch in signature, old address proof or counterfoil of dividend warrant received from the Company or bank statement showing credit of dividend to be obtained even if there is no objection received from the old address/new address.

In case where the letter is undelivered at the old address, RTA shall obtain address proof for old address as mentioned above; or counterfoil of dividend warrant received from the Company or bank statement showing credit of dividend. In case of any doubt in the documents received, the RTA/Company shall do Personal Verification at the new address of the holder and after positive feedback, address will be changed.

If the Applicant is a body corporate:

Duly certified board resolution for change in address;

A copy of form INC-22, filed with the concerned Registrar of Companies, in cases where applicant is a company.

Self-attested copy of proof of new address:

Valid passport / Ration Card/ Registered Lease or Sale Agreement of Residence / Flat maintenance bill

Driving licence

Electricity bill*

Telephone bill (Landline)*

Gas bill*

Identity card / document with address issued by either Central /State Government and its departments, Statutory / Regulatory Authorities, PSUs, Scheduled Commercial Banks. Public Financial Institutions.

For FII /sub account, POA given by FII /sub account to the Custodians (which are duly notarized and / or apostilled or consularised) that gives the registered address.

The proof of address in the name of the spouse.

Client Master List (CML) of the Demat Account of the holder / claimant, provided by the Depository Participant.

*Documents under point 3,4,5 should not be more than 3 months old.

In case the documents submitted as Flat Maintenance Bill or Proof of address in the name of spouse, additional self-attested copy of Identity Proof of the holder/claimant may be obtained.

CHANGE IN SPECIMEN SIGNATURE

Application in Form ISR-1 and Banker Attestation Form ISR-2.

Original cancelled cheque with the name of the security holder printed on it.

REGISTRATION OF POWER OF ATTORNEY

Application

Original or copy of Power of Attorney duly attested by Notary Public

Self-attested copy of the PAN Card of the applicant and the attorney holder

Attested copy of any other identity proof of the applicant and the attorney holder

Proof of encashment of dividend

CORRECTION OF NAME

Application form in Form ISR-1

For minor mismatch in name between any two set of documents presented by holder / claimant for any service request, the RTA shall additionally obtain any one of the following documents, explaining the difference in names;

Unique Identification Number (UID) (Aadhaar)

Valid Passport

Driving license in Smart Card form, Book form or copy of digital form shall be accepted

PAN card with photograph

Identity card / document with applicant’s Photo, issued by any of the following: Central / State Government and its Departments, Statutory / Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, Public Financial Institutions.

Marriage certificate

Divorce decree

In cases where the name is slightly not matching with the registered name and the holder is not able to furnish any document, in such cases, affidavit to be obtained.

Original share certificate(s)

TRANSPOSITION OF NAME

Application form [duly signed by the joint holder(s)] in Form ISR-4

Self-attested copy of PAN Card of all joint holders

Proof of the registered address of the first holder

Original Share Certificate(s)

Self-attested copy of other identity proof

Bank statement for encashment of dividend received from the Company

CHANGE/UPDATION IN PAN

Application form in ISR-1

Self-attested copy of PAN Card. PAN should be linked with Aadhaar

NOMINATION /OPTING OUT OF NOMINATION

Application in duly filled up Form SH-13 (Only one Nominee can be nominated per folio) and form ISR-1

Duly filled up Form SH-14 (change in existing nomination)

Cancellation of existing nomination. Form ISR-3 (Declaration to Opt out) and Form SH-14

OTHER CHANGES

Application form in ISR-1 is required for all the change request

Change in Bank detail:

Copy of bank statement with details of bank name, branch, account number and IFS code or copy of cheque leaf.

Alternatively, details available in the client master list of demat account will be updated.

- Email address:

Email address in Form ISR-1 or alternatively, details available in the client master list of demat account will be updated.

- Mobile Number:

As provided in Form ISR-1 or alternatively, details available in the client master list of demat account will be updated.

CHANGE OF SHARES/ DIVIDEND FROM IEPF

Whether e-Form is to be filled online?

Yes. Forms filled in physical mode are summarily rejected.

Whether a professional help is required to fill e-Form IEPF – 5?

No. The procedure for filling the e-Form is simple. On a plain reading any literate individual can fill e-Form on his own. The prescribed Form is not only very precise but also very friendly in filling up. A general guidance kit is also attached with the form for any help, if required for filling up such Form. For any further help the IEPF helpline can also be contacted.

Whether Government has appointed or empanelled any professional to help in making claims to the claimant.

For any such information, kindly refer to the website of IEPF authority.

What are the documents required to be submitted with IEPF -5?

Documents which are required to be submitted are:

Print out of duly filled claim form with claimant signature and if joint holders are involved then the Form should be signed by all the joint holders along with annexures submitted with form.

Copy of acknowledgement, generated online, on submission of form IEPF – 5 bearing a unique serial number (SRN).

Copy of Indemnity Bond (original) auto generated after uploading the claim Form IEPF 5 with claimant signature and proof of payment of applicable stamp duty. It should be signed by the claimant and witnesses and shall be duly notarised.

- For claim of amount of Rs. 10,000 or more - Non-judicial stamp paper of appropriate value according to state is required.

- For claim of amount of less than Rs 10,000 - Plain paper

Original share certificate (in case of securities are held in physical form) or copy of transaction statement, in case of securities held in Demat form.

Identity & Address proofs:

- In case of Indian Citizen

Self-attested copy of Aadhaar Card

Self-attested copy of PAN Card

NOTE - In case of non- availability of Aadhaar Card for super senior citizens or some specific states, other ID proofs issued by government clearly mentioning the address of the claimant needs to be submitted.

- In case of NRI

Self-attested copy of Passport; or

Self-attested copy of Overseas Indian Card (OIC) issued by MHA along with any of the documents available with him.

- In case of foreigners

Copy of Passport or PIO Card duly apostatized as per Hague Convention

Affidavit for change/mismatch of address and/or name

Proof of entitlement (share certificate/ dividend warrant/ certificate issued by Company/ RTA).

Original cancelled cheque leaf. (In case, cheque leaf doesn’t have Name, Bank and Branch Name, IFSC Code etc. printed on it, copy of passbook, duly attested by the Bank can be submitted)

Original self-attested client master list (where claim is for shares) - In case of joint shareholding, it shall be in the name of joint holders and shall be self-attested by joint holders, if not, then NOC shall be given by remaining joint shareholders.

In case any Joint holder is deceased, copy of death certificate to be attached.

In cases of transmission, loss of original shares, mismatch in name and address etc., the claimant is advised to complete the relevant documents/ process and then approach the IEPF authority for filing the claim.

Any other document relevant to prove entitlement of the claimant.

What is the format for indemnity bond?

The Indemnity Bond is auto generated on the portal of Ministry of Corporate Affairs after uploading the form IEPF 5.

What is the required value of the stamp paper for the indemnity bond?

In case of refund of dividend amount of Rs. 10,000 or more and/or market value of shares, non- judicial stamp paper of appropriate value as prescribed under Stamp Act according to state is required. For claim of only amount of Rs. 10,000 or less, indemnity bond can be executed on a plain paper.

What is the value to be filled in the number of shares and amount in the indemnity bond?

The number of shares and amount should be the same as that mentioned in the Entitlement Letter issued by the Company. Further, the details entered in the Form IEPF-5 should also be the same as that in Entitlement Letter.

In case of non-availability of Aadhar Card, what other documents can be submitted as proof of identity?

In case of non-availability of Aadhar Card for super senior citizens or some specific states, other ID Proofs issued by government clearly mentioning the address of the claimant needs to be submitted.

Is original share certificate required to be submitted?

Yes, original certificate is required to be submitted. In case of loss of original share certificate, documents enclosed for – Issue of Duplicate share certificate needs to be furnished to the RTA.

What happens if the name on original certificates is not matching with the PAN or address on the Proof of Identity is not matching with company’ records?

In such case as per SEBI Guidelines, an affidavit explaining the above deviation needs to be submitted. In case of mismatch in name, proof of name as on share certificate or change of name viz. marriage certificate, gazette notification etc. needs to be submitted. In case of mismatch in address, new address needs to be updated with the company.

What information is required to be filled in field “Details of shares claimed” and “claim details” of the e-form IEPF 5, such as details of shares claimed, Folio No., DP/ID client ID/ Account No., category, kind of shares, number of shares; details of amount claimed, dividend amount etc.

The claimant shall fill the information as mentioned in the Entitlement Letter issued by the Company. . However, it may be endeavoured that all folios against which refund of share need to be claimed are filled in the same form. Similarly, dividend and other amount may be mentioned for all the years. The company ensures to recommend refund of all the shares and amount for which the claimant is entitled together at once.

Why are Client Master List and cancelled Original Cheque leaf required?

CML and cancelled Original Cheque leaf are required to verify the DEMAT and Bank Account in which transfer is to be made. In case, Cheque leaf doesn’t have Name, Bank and Branch Name, IFSC Code etc. printed on it, copy of passbook, duly attested by the Bank can be submitted.

What are the documentary requirements in case claimant is a legal heir?

In such case, one needs to first follow the procedure prescribed for transmission of shares. On successful completion of the transmission request, the Company shall issue an ‘entitlement letter’ to the claimant. Thereafter, the claimant may raise a claim with IEPF authority by following the instructions provided on the website of IEPF.

What is re-submission and time period for re-submission?

For rectification of errors in e-form IEPF 5/Verification Report, IEPF Authority provides one more chance to the claimant/company to correct the details and to re-submit the form/verification report again, such act of the Authority is called Resubmission. It may be noted that only one resubmission is allowed. A 15 days’ time period is allowed for making resubmission of claim application. In case resubmission is not done in the prescribed time, the form becomes invalid.

Where are the documents required to be sent by the claimant after the prescribed claim form is filled up.

The documents are required to be sent to the Nodal Officer of the Company at Registered office of the Company.

What are the actions on the part of claimant that helps the Authority to refund the claims in minimum time.

It is advised that at the time of submission of information in IEPF 5 form, claimant should ensure correctness of information such as Aadhaar No., Demat No., Bank Account No., IFSC Code, etc.

What is the prerequisite before filing IEPF-5?

Claimant should approach the company for issue of entitlement letter before submitting e-form IEPF-5. After verification of all the documents filed by Claimant, Company will issue Entitlement letter containing all the details relating to unclaimed dividend and shares transferred to IEPF alongwith information required to file the form IEPF-5.

PROCESS OF REFUND OF SHARES BY IEPF

CLAIMANT TO CLAIM DIVIDEND AMOUNT AND/OR SHARES BY SUBMITTING AN ONLINE APPLICATION IN FORM IEPF-5.

Before submitting e-form IEPF 5, Claimant should approach the Company along with required documents for issue of the entitlement letter.

Within 30 days from submission of complete documents by the claimant, Company will issue entitlement letter containing all the details relating to unclaimed dividend and shares transferred to IEPF alongwith information required to file form IEPF-5.

Post submission of Form IEPF-5, RTA sends an intimation to claimant through email and/or physical letter requesting him/her to provide original documents.

The claimant to send all original signed documents to the Nodal Officer at the registered office of the Company within 7 days of the submission of the Form IEPF-5.

Company to verify all the original documents sent by claimant. If the same are found in order, the claim is approved by the Company, otherwise a discrepancy letter is issued to the claimant.

Company to submit the Verification Report to the IEPF/MCA within 30 days of receipt of claim.

IEPF to examine completeness of documents and if found in order, the claim is approved by the IEPF Authority. Otherwise, discrepancy email is sent by the IEPF to rectify the details/documents.

Company / Claimant to rectify the details/ documents within 15 days of issuance of discrepancy.

After submission of all the documents & discrepancies, duly completed in all respects, the IEPF Authority approves the claim and release the shares and/or dividend to the demat account and/or bank account of the claimant.

PAN, KYC & NOMINATION

Is it mandatory to furnish /update PAN, KYC details and Nomination by holders of physical shares?

The SEBI vide its circular SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/37 dated March 16, 2023 has made it mandatory for all holders of physical securities in listed company to furnish the following documents / details to the RTA:

a) PAN

b) Nomination (for all eligible folios)

c) Contact details - address with PIN, Mobile number

d) Bank account details (bank name and branch, bank account number, IFS code)

e) Specimen signature

Please note, while processing any service requests or complaint from the shareholder(s) / claimant(s), the RTA will obtain documents / details of PAN, KYC details and Nomination, wherever the same is not available in the folio.

What is the timeline for registering/updating KYC in the records of the Company/RTA.

| NATURE OF SERVICE | EXPECTED TIMELINES (NUMBER OF DAYS) |

| Processing of request for change in/up-dation of | |

| a. Name | 30 |

| b. Signature | 30 |

| c. Nomination | 30 |

| d. Contact details (Address, Mobile number, etc.) | 15 |

| e. Bank account details | 15 |

| f. PAN | 15 |

With regard to nomination, the cancellation or variation in nomination shall take effect from the date on which the duly completed and signed intimation is received by the RTA/Company.

If the KYC is not furnished / updated by the holder of physical shares, what would be the consequences?

The folios wherein any one of the PAN, KYC details and Nomination are not available shall be:

a) eligible to lodge grievance or avail service request from the RTA only after furnishing the complete documents / details/ KYC as aforesaid.

b) eligible for any payment including dividend, interest or redemption payment in respect of such folios, only through electronic mode with effect from April 1, 2024. An intimation shall be sent to the holder that such payment is due and shall be made electronically only after updation of aforesaid details.

Is it compulsory to link PAN and Aadhaar by all holders of physical shares?

Yes, Central Board of Direct Taxes (CBDT) has made it mandatory to link PAN & Aadhaar number by the date specified by CBDT.

The folios in which PANs is / are not valid and where PANs is/are not linked to Aadhaar, as on the notified date as may be specified by the CBDT, shall also be frozen.

FOR DOWNLOADING THE FORMS FOR FURNISHING/UPDATING KYC DETAILS AND NOMINATION – PLEASE CLICK ON THE FOLLOWING LINK:

CONTACT US

The shareholders are advised to mention their Folio No. and Contact No. in all their communication sent to the RTA/Company.

All communication concerning transfer/transmission of shares, change of critical details like address, name, loss of certificate, nominations, etc. should be addressed to the Company's Registrar and Share Transfer Agent. Please note that for any queries or requests, the shareholders are advised to write to the Company's RTA (Registrar and Transfer Agent) on the following address:

KFin Technologies Limited(Registrar and Transfer Agent)

Selenium Building, Tower-B, Plot No 31 & 32, Financial District, Nanakramguda, Serilingampally, Hyderabad, Rangareddy, Telangana, India -500 032.

Toll Free No : 1800 309 4001

E-mail: einward.ris@kfintech.com

WhatsApp Number : (91) 910 009 4099

KPRISM (Mobile Application): https://kprism.kfintech.com/

KFINTECH Corporate Website: https://www.kfintech.com

RTA Website: https://ris.kfintech.com

Investor Support Centre (DIY Link): https://ris.kfintech.com/clientservices/isc

Click to download our AGM Notices.

AGM Notice 2024-2025

Download

AGM Transcript

Download

INFORMATION TO SHAREHOLDERS

.png)

The Securities and Exchange Board of India vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2024/81 dated June 10, 2024 has, inter-alia, decided that non-submission of the “choice of nomination” shall not result in freezing of Demat Accounts as well as Mutual Fund Folios.

The complete copy of the circular is enclosed below.

Read More

Read Less

Circular

The SEBI vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2023/193 dated December 27, 2023 has extended the last date for submission of ‘choice of nomination’ for demat accounts to June 30, 2024.

The complete copy of the circular is attached below.

Read more

Read less

Circular

The SEBI vide its circular no.SEBI/HO/MIRSD/POD-1/P/CIR/2023/181 dated November 17, 2023 has removed the following provisions with respect to physical folios:

The folios wherein PAN, Nomination, Contact details, Bank A/c details and Specimen signature are not available on or after December 31, 2023 shall be frozen by the RTA.

The folio(s) which have been frozen shall be referred by the Company/RTA to the administering authority under the Benami Transactions (Prohibitions) Act, 1988 and or Prevention of Money Laundering Act, 2002, if they continue to remain frozen as on December 31, 2025.

The complete copy of the circular is attached below.

Read more

Read less

Circular

The SEBI vide its circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2023/158 dated September 26, 2023 has extended the last date from September 30, 2023 till December 31, 2023 for submission of the following documents/information to avoid freezing of folios/demat accounts:

For physical shareholders - PAN, Nomination, Contact details, Bank A/c details and Specimen signature; and

For demat account holders – submission of choice of nomination.

Note: For trading accounts, ‘choice of nomination’ has been made voluntary.

Read more

Read less

Circular

The SEBI vide its master circular no. SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/145 dated July 31, 2023 (updated as on August 4, 2023) provided for a common online dispute resolution portal for resolving grievances/disputes of investors in the Indian Securities Market. In line with this circular, a gradual process for resolving disputes of investors exist under the ambit of SEBI and Stock Exchanges & Depositories. Therefore, in case of any grievances, the investor shall first approach the Company/RTA. If the investor is not satisfied with the resolution provided by the Company/RTA, he/she may file the concern/complaint on SCORES which is SEBI's investor grievance redressal portal. If the investor is further dissatisfied with the resolution on SCORES, he/she may file the concern/grievance on SMART ODR and the issue will be redressed accordingly. The link of SCORES Portal and SMART ODR Portal are provided hereunder for quick access. Further, the complete copy of the circular is also placed below.

Read more

Read less

Circular

SEBI vide circular no. SEBI/HO/MIRSD/POD-1/P/CIR/2024/37 dated May 07, 2024 has issued a Master Circular for Registrars to an Issue and Share Transfer Agents.

Read more

Read less

Circular

PROCEDURE FOR DEMATERIALISATION (DEMAT)

- The client (registered owner) will submit a request to the DP in the Dematerialisation Request Form for dematerialisation, along with the certificates of securities to be dematerialised. Before submission, the client has to deface the certificates by writing "SURRENDERED FOR DEMATERIALISATION"

- The DP will verify that the form is duly filled in and the number of certificates, number of securities and the security type (equity, debenture etc.) are as given in the DRF. If the form and security count is in order, the DP will issue an acknowledgement slip duly signed and stamped, to the client.

- The DP will scrutinize the form and the certificates. This scrutiny involves the following:

- Verification of Client's signature on the dematerialisation request with the specimen signature (the signature on the account opening form). If the signature differs, the DP should ensure the identity of the client.

- MOA & AOA

- Formats: Deduction of Tax at source on Dividend Payment

- Annual Return

- Formats

- PAN, KYC & Nomination Details in terms of SEBI Circular no. SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/37 dated March 16, 2023

- Forms for registering / updating the KYC details

- Forms for processing of various service requests

Click to download our MOA & AOA.

Memorandum and Articles of Association of Hero MotoCorp Ltd. - 4.78 MB

Download

Click to download our Formats: deduction of tax at source on dividend payment.

Form 15H

Download

Form 15G

Download

Self declaration for Resident SH other than Individuals

Download

Self declaration for DTAA applicability

Download

Declaration under Rule 37BA

Download

Email communication to shareholders- 06-02-2025

Download

Click to download our Annual Return.

Annual Return- FY 2024-25 - 184.59 KB

Download

Click to download our Formats.

Application Change of Name - 12.76 KB

Download

Recording Change Of Name - 12.44 KB

Download

Application Correction Of Name - 13.01 KB

Download

Dividend Mandate Form - 15.69 KB

Download

Dividend Revalidation Form - 12.72 KB

Download

Application Duplicate Dividend Warrants - 13.15 KB

Download

Indemnity Bond - 16.40 KB

Download

Name Deletion Form - 46.41 KB

Download

Application Registration of Power of Attroney - 13.10 KB

Download

Specimen Signature Form - 12.30 KB

Download

Intimation to Shareholders - 11-Oct-24

Download

Intimation to Shareholders - 15-Jul-24

Download

Issue of Duplicate securities certificate - ISR-4 - 830.68 KB

Download

Replacement / Renewal / Exchange of securities certificate - ISR-4 - 830.68 KB

Download

Consolidation of securities certificate- ISR-4 - 830.68 KB

Download

Sub-division / Splitting of securities certificate - ISR-4 - 830.68 KB

Download

Consolidation of folios - ISR-4 - 830.68 KB

Download

Endorsement - ISR-4 - 830.68 KB

Download

Change in the name of the holder-ISR-4 - 830.68 KB

Download

Change in status from Minor to Major and Resident to NRI and vice versa - 2.88 MB

Download

Claim from Unclaimed Suspense Account & Suspense Escrow Demat Account - ISR-4 - 830.68 KB

Download

Transposition - ISR-4 - 830.68 KB

Download

Transmission - ISR-4, ISR-5 - 2.07 MB

Download

TRANSFER OF SHARES

GUIDANCE NOTE:

SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 mandates that the transfer, except transmission and transposition, of securities shall be carried out in dematerialized form only, with effect from 1st April 2019.

For any further queries you may please write to the Company's RTA.

In view of the numerous advantages offered by the Depository system as well as the ease of holding, members holding shares in physical mode are advised to avail of the facility of dematerialization from either of the depositories and get their physical shares dematerialized.

Are shares of Hero MotoCorp required to be traded compulsorily in demat form? Can a Shareholder hold the shares in physical form?

Yes. The shares of Hero MotoCorp are to be compulsorily traded in demat form. However, one can still hold the shares in physical form.

In view of the numerous advantages offered by the Depository system as well as the ease of holding, members holding shares in physical mode are advised to avail the facility of dematerialization from either of the depositories and get their physical shares dematerialzed.

Can I gift my shares in physical form?

No. Gifting of shares is equivalent to transfer of shares therefore it can be done only in demat form.